When you’ve got your head down running your business, it can be really challenging to get some perspective on how things are going—even something as straightforward as how much money you should be making.

Unless you happen to have a finance or accounting background, digging into your financial numbers likely isn’t one of your favorite things to do. However, it’s critical that you have a basic understanding of how your business actually runs. You’ve got to understand how (or if) you actually make money.

One of these key financial ideas that comes up frequently is the question of how much money should a business owner make, both in terms of salary and profits. Unfortunately, the most accurate answer is “it depends.” Every industry is different in terms of profit margins and market based wages, and there can also be a huge difference in individual businesses within an industry, based on things like their maturity, competition, geography or other factors.

Despite all of that, how much you should make is still an important question and definitely worth thinking about. Luckily, author and speaker Mike Michalowicz has clearly thought about this topic a lot. In fact, in his book, “Profit First,” he does a great job of digging into this very idea. He has created what he calls an Instant Assessment (you can find it on his website under “Resources”) that helps you calculate a ballpark approximation of what your profit, owner’s pay, taxes and operating expenses should work out to, based on your revenues.

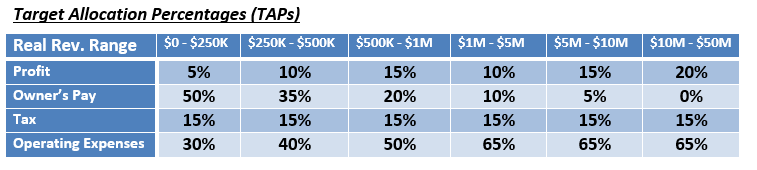

The engine behind his assessment process is the following table—Target Allocation Percentages, with Revenue Ranges across the top and the various categories down the side. So as an example, a company doing $2 million in real revenue (I’ll explain below) should target a profit of 10 percent of that $2 million, owner’s pay of 10 percent, taxes of 15 percent and operating expenses of 65 percent.

Take a couple of seconds to study the chart. There are several interesting things that stand out about it:

What is Real Revenue?

Michalowicz defines Real Revenue as your top-line revenue less what you paid for subcontractors or materials. So if you’re a $10 million general contracting company, and you pay out $8 million to subcontractors, your real revenue is $2 million, not $10 million.

Profits are hard to come by – The profit line ranges from 5 percent for a startup to 20 percent for a mature, established $10 million-plus business. This is a ballpark approximation for general small business, weighted towards service-related businesses since that’s the majority of what’s out there. You will hear stories of companies that make huge profits (30 percent, maybe even 50 percent or higher) but you have to realize a few things. For starters, you can’t believe everything you hear, and if someone IS making that kind of profit, then you can bet that others are going to be getting into that business soon and competing, which will drive that profit margin down quickly.

Finally, there are some industries (i.e. manufacturing) that would love to make 10 percent profit some day. If you’re in a highly competitive, nondifferentiated industry, you just aren’t going to have great profit margins.

Black Hole at $1 Million to $5 Million

Most businesses experience a very challenging growth period between $1 million and $5 million, mostly because that’s when you have to really start investing in overhead (larger management team, equipment, automation, etc.) if you want to grow. That investment costs money and makes you less profitable.

Owners Don’t Make Anything at $10 Million?

If you look closely, the owner’s pay drops to 0 percent at $10 million. That doesn’t imply that an owner doesn’t get to make any money at that point, it’s more of a recognition that the profits at that level end up being a lot of money and the owner can (and maybe should?) consider hiring a CEO and promoting themselves to the chairman of the board role instead, where you don’t take a salary and instead just take profit distributions.

It’s important to note that the Target Allocation Percentage table is a high-level estimating tool, more of a rule-of-thumb-type of guide. There are big spikes because it’s a simple table. If you’re around the $1 million mark in revenue, then there’s a huge jump in expenses as you cross to the next range. Obviously, that’s not how it works in the real world, but the table can still give you a reasonable ballpark to work with.

How Much Money Should You Be Making in Your Business?

Based on the “Profit First” assessment, how are you doing? If you’re like a lot of business owners, the information in the assessment process will be a wake-up call. It’s common for business owners to be short of those numbers. That doesn’t mean your business (or you) are broken beyond repair, it just means that there’s room for improvement. With focus and consistent effort, you can start steering towards a much healthier outlook over time.