As a business owner, you have to juggle a number of priorities, one of which is paying your employees. With ever-changing tax laws and the complexities of the Affordable Care Act, it might be time for you to consider outsourcing your payroll.

What are the top signs that you might want to consider outsourcing?

- You’re spending way too much time on it. It can be a time-sucking activity that takes precious productivity away from both you and your staff. And outsourcing your payroll could allow you to reduce your current payroll staff.

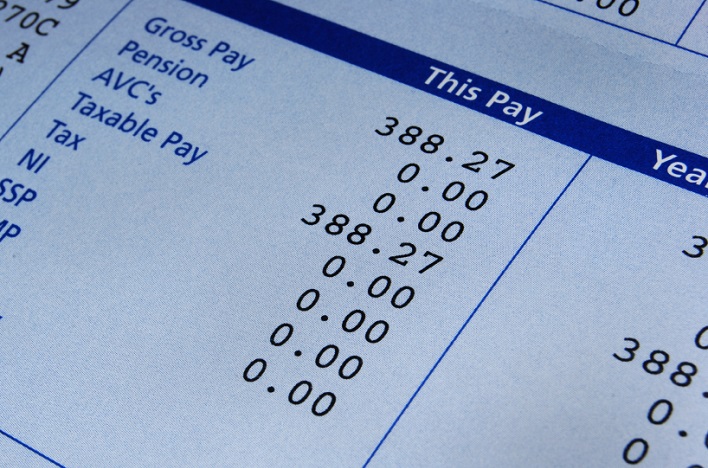

- The cost of managing payroll is eating your budget. Not only do you have to incur salaries and benefits for your staff, but there are other costs, too, like printing and distributing checks and reports.

- You don’t have great internal controls. Potential fraud is one reason why outsourcing may make sense. Having a fresh set of eyes from an outsourcing firm provides another layer of protection. Your provider knows the payroll processes and red flags that could indicate a potential fraud issue.

- Accuracy is a concern. Payroll mistakes happen. And they can be costly. Chances are good that a payroll services firm will make fewer mistakes than your staff, given that it will stay current on tax laws and have processes in place to catch mistakes.

- Your company is growing to other states. Growth is great, but often comes with a price tag. If your company is expanding to other states, staying on top of payroll is going to be a challenge.

- The Affordable Care Act. Staying on top of the Act is a challenge, particularly since the reporting requirements can be onerous. Payroll service providers know what exactly what needs to be reported or tracked, which lessens the burden on your or your staff.

- Speed and seasonality. Payroll specialists have terrific technology so they can manage payroll quickly. And a good service will also understand if you have seasonality issues with your business, like having to hire additional staff at peak times during the year.

- You’d like to offer other payroll benefits to your employees. Direct deposit, pay cards and the ability for your employees to manage their payroll and benefits online are really important. And today are pretty much expected when you’re recruiting new employees.

- Your staff tends to turn over. If you have a revolving door in your payroll department, you’re probably spending time (and more money) having to find and train new staff. Sending your payroll to a service provider will keep the disruption to a minimum.

- You can sleep at night. Peace of mind is can be worth the investment to outsource payroll. Not having to worry about payroll will give you more time (and energy) to focus on other aspects of your business.