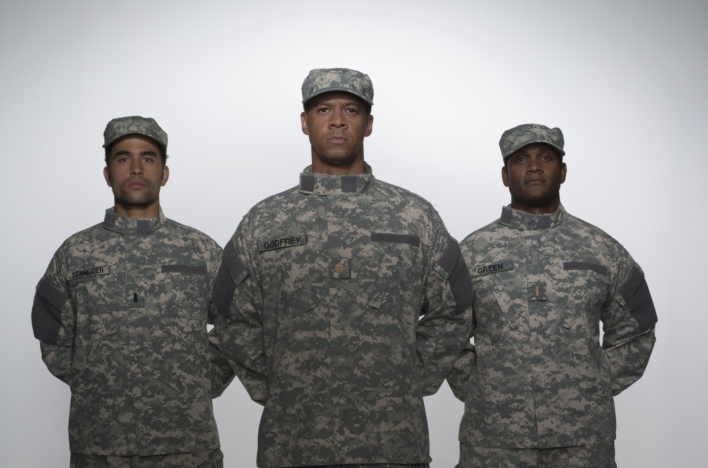

Small businesses can take a big hit when the owner or a vital employee is a military reservist called up to active duty. Offering help is the U.S. Small Business Administration, which allows businesses in that situation to apply for a low interest loan of up to $2 million.

A Military Reservist Economic Injury Disaster Loan (MREIDL) can be sought at any time between the notice of expected call-up to one year after the date of discharge or release.

“The absence of just one employee whose expertise is critical to the success of the company can pose significant challenges for a small business,” SBA Acting Administrator Jeanne Hulit said in a release. “These Military Reservist Economic Injury Disaster Loans provide funds that will help these small businesses cover operating expenses. This way, our brave men and women in uniform don’t have to choose between serving their country and growing their businesses.”

Managed by SBA’s Office of Disaster Assistance, the MRIEDL is a direct working capital loan. The interest rate is 4 percent, with terms up to 30 years. Generally, no collateral is needed to get an MREIDL of $50,000 or less. The loan may not be used to restore lost income or profits, refinance long-term debt or to enlarge the business.

Businesses can apply at this website. To receive an application by mail, or for other questions about the loan program, contact SBA’s Disaster Assistance Customer Service by calling 800-659-2955 or emailing diastercustomersevice@sba.gov.

For information about further opportunities for veterans through the SBA, go to www.sba.gov/veterans.